You are in section Home Mortgages Mortgage guides Can a low EPC rating affect your mortgage application?

Can a low EPC rating affect your mortgage application?

Your home may be repossessed if you do not keep up your payments

It can sometimes be difficult to get a mortgage on a property with a low Energy Performance Certificate (EPC) rating.

Here, we look at what an EPC is and why it matters when it comes to buying a property.

What is an Energy Performance Certificate (EPC) rating?

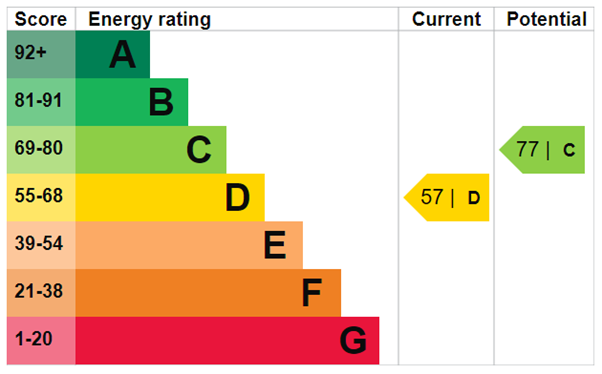

An EPC rating measures the energy efficiency of a property from A (extremely efficient) to G (least efficient).

The higher the rating, the lower your energy bills are likely to be. A poor EPC rating suggests low energy efficiency, which means it will cost you more to heat and power the property.

EPCs also provide information on things like the property’s carbon dioxide emissions, which can give you an idea of its environmental impact.

The average EPC rating for a home in the UK is D. Properties that achieve a rating of A tend to be brand new environmentally-friendly homes that have a low carbon footprint.

EPCs provide two ratings; current and potential.

This shows how efficient the property is now, and how much it could be improved with some recommendations listed on the EPC. It also includes the typical installation cost and typical yearly saving of each measure.

Where can you find the EPC rating of a property?

If you’re buying a home, the person selling the property must show you the EPC. If you’re renting, it’s the landlord’s responsibility to provide one.

You can also find out if a property has a valid EPC on the government register.

Some properties don’t require an EPC, such as certain listed buildings, but it’s worth checking to make sure.

Why is a home’s energy performance important?

According to the Climate Change Committee (CCC), 40% of UK emissions come from households.

The CCC recommends all UK homes reach an EPC of at least band C by 2028 – to help the government meet its net zero carbon target by 2050. Only 29% of UK homes meet this standard today.

Landlords are also affected. At the moment, rental properties must have an EPC rating of E or above for legal reasons, but the EPC threshold may increase in the future.

You may need to carry out additional insulation work or other improvements to make a home more energy-efficient – before you’re able to let or, potentially, sell the property.

Can you get a mortgage with a low EPC rating?

Due to the impact low energy-efficient homes have on the environment, lenders may need to factor EPC ratings into lending decisions.

This is something to be aware of when considering certain properties to buy.

If the property you’re looking to buy has an EPC below what we might expect, and little room to improve it with recommended measures, you could find your application is rejected.

If we reject your application we’ll show you the reasons why, and it’s important to remember that if it’s only because of the EPC rating of the property, we could give you a mortgage on a different property.

Explore more

Find the mortgage for you

Think carefully before securing other debts against your home. Your home may be repossessed if you don't keep up repayments on your mortgage.